Bristol’s burgeoning tech industry is making the city a hub of scale-up activity and a magnet for venture capital investment, according to new research by global accountancy group KPMG.

Of the £364m invested in 21 new businesses across the South West last year, some £307m went to Bristol businesses, KPMG’s Venture Pulse survey shows.

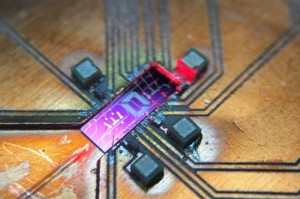

The biggest investments were $200m (£153m) in Graphcore, the semiconductor company that develops accelerators for AI and machine learning, £35m in Ultrahaptics, the world leader in mid-air touch technology, and $40m (£30.6m) went to KETS Quantum Security, which is developing a range of future-proof, cost-effective technologies for quantum-secured communications.

KPMG Bristol partner Kay Drury, pictured, said: “Over the past decade Bristol has established itself as an engine of start-up creativity. We can now see that the start-ups have moved onto the next level, having proved their product to the market as well as their financial model.

“Investors who traditionally focus on London are now well aware of the South West and this is helping local businesses to secure the attention and investment they need to grow.”

From a UK wide perspective, KPMG’s Venture Pulse survey showed that despite ongoing uncertainty around Brexit, the UK continued to attract significant levels of venture capital.

Against a total investment in Europe of $24.4bn last year, $7.7bn went to the UK – an amount 1.5 times the level invested in fast-growth businesses in Germany, and 2.6 times the level of investment seen by the start-up ecosystem in France.

Head of KPMG’s innovative start-up practice Patrick Imbach said: “For years now, the true implications of Brexit have remained open questions, however, the venture ecosystem would appear to have been unaffected so far. Global VC investors continue to be attracted to good quality UK businesses, and are particularly focused on larger and later stage deals.

“Like the rest of Europe, the UK has seen a decline in the number of completed financings towards the end of 2018, indicating that as the deadline approaches, investors are starting to grow more cautious, waiting to see whether a plan materialises.

“Concern around competing for talent will dominate conversations being had by entrepreneurs across the UK and could impact the growth of innovation and our start-up sector as we face what is likely to be a challenging year ahead.”