Bristol and London law firm Temple Bright has advised the owners of long-established rugby club Saracens on a complex deal involving a reorganisation of its parent group and a £32m equity investment led by a consortium that includes a number of high-profile business and sporting figures.

of the deal, which was first announced last October, follows the required approvals, including from the Rugby Football Union (RFU), Premiership Rugby Limited (PRL) and the London Borough of Barnet.

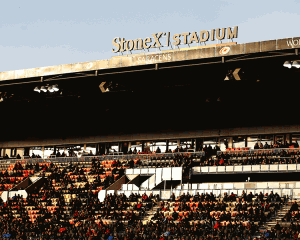

The North London club’s owner Saracens Group also includes Saracens Mavericks Limited, which owns the Saracens Mavericks netball team), and Saracens Copthall LLP, the owner of the StoneX Stadium, pictured below.

As a result of the deal, a controlling stake in the group passes to the Kimono House Limited.

Investors in Kimono include Dominic Silvester, chief executive officer of global insurance group Enstar, Neil Golding, the club’s chairman and a partner at law firm Freshfields, Enstar director Paul O’Shea, former Saracens player and world cup-winning captain Francois Pienaar, Nick Leslau, chairman and chief executive of Prestbury Investment Holdings, and Marco V. Masotti, a partner at Paul Weiss and an owner of South Africa’s Sharks rugby team.

The capital raised will be used to maintain the club’s position at the top of the men’s game and for a variety of other purposes, including completing the redevelopment of the StoneX Stadium’s West Stand, further investment in women’s sport and establishing a high-performance training centre.

Saracens returned to the Premiership this season after a year in the RFU Championship following a 35-point deduction and £5.3m fine in November 2019 for breaching salary cap rules.

Neil Golding said: “We move on from the recent challenges with hard lessons learned and with robust new governance procedures in place.

“We wish to thank the incredible fans and sponsors of Saracens for their continued support.

“Dominic, Nick and Francois all have a long association with the club and we are delighted that they are committed to its future.”

Former Saracens chairman Nigel Wray, who stood down in January 2020 following the points deduction, added: “I have given my heart and soul to the club for more than two decades, having chaired Saracens since the first days of professionalism.

“Sadly, I’m not getting any younger and I have always wanted to make sure that Saracens is in very safe hands for many future generations.

“To show our continued enthusiasm for the future of Saracens I will be retaining a significant minority shareholding albeit a passive one.”

He said he was thrilled to hand over control to a consortium comprised of people who he knew well and who understood the culture the club had been able to create over more than 20 years on and off the field, particularly within the community through the Saracens Foundation and the Saracens Multi-Academy Trust.

“I am looking forward to becoming just a fan again and supporting the club I love whilst focusing more of my time on the pioneering work of our amazing Foundation and supporting the build out of the Saracens school programme,” he added.

Dominic Silvester said the Kimono House consortium members were making a long-term commitment to Saracens, with the new funds used to maintain the club’s position at the top of the game for the future.

“We also have an exciting longer-term vision to make the club a global market leader both on and off the field and we are well placed to deliver on this with our wide-ranging international experience.

“We want to also personally thank Nigel for all he has done for modern rugby and player welfare, more than perhaps any other single person. It is our privilege to take Saracens onto a new chapter and we intend to be every bit as ambitious and pioneering as Nigel has been.”

Kimono House Limited was advised by US and global law firm Mayer Brown. Temple Bright advised the Wray family and related entities. The Temple Bright team was led by corporate partner Stuart Hutson and included Nick Manassei (commercial and regulation) and David Sanson (real estate).

Stuart, pictured, said: “We are delighted to have advised on this landmark deal for Saracens, which sets the course for an exciting next phase in the club’s long story.

“This was a highly complex transaction, which has involved a huge amount of work by all those involved over a two-year period, all in the midst of the pandemic.

“In addition to advising on the reorganisation of the group and the new investment, Temple Bright has also led on obtaining regulatory consents from PRL, RFU, England Netball, Barnet Council, and Department of Media, Culture and Sport – this aspect ably led by my partner Nick Manassei.

“Despite the significant challenges which are inevitable in such a complex transaction, the process has been a pleasure throughout, owing to the professionalism of all parties and their advisers. We look forward to the rest of the season, which has already seen some great performances from all of the Saracens teams.”

Temple Bright was launched in 2010 using a tech-enabled, streamlined business model. The firm now has over 70 partners spread across offices in Bristol and London.

The firm advises clients ranging from start-ups to PLCs across a range of sectors. It has particular strength in corporate transactions and has continued to advise on a large number of deals over the past two years despite the disruption caused by the pandemic.