New technologies such as much cheaper storage batteries and more widespread use of rooftop solar cells are set to transform the UK energy market, experts told a Barclays-staged roundtable discussion in Bristol.

With government subsidies for solar farms and onshore wind projects being cut dramatically, the focus is now shifting towards smaller-scale generation and better storage, the event heard.

This new market could generate opportunities for businesses to sell their spare energy – creating valuable revenue streams and helping them meet their environmental targets, the panel of experts explained.

The event – which took as its backdrop the changing energy market and the shift towards locally generated power – heard that some businesses with large buildings fitted with photovoltaic (PV) cells on the roofs were now profitably exporting their spare electricity.

At the same time, research into more powerful battery capacity was creating a new market that could revolutionise the way energy is used – allowing businesses and consumers, for the first time, to store power and use it later.

On the panel at the event, staged at Barclays’ Bristol regional office, were Chris Nishan, vice president, Barclays – Infrastructure & Project Finance; Maria Connolly, partner at law firm TLT; Steve Edwards, technical & strategy director at British Solar Renewables – a cleantech company based near Glastonbury; David Pike, KPMG head of corporate restructuring South; and Bridget Beals of KPMG’s energy corporate finance team.

Bridget Beals told the invited audience of business owners – including a number from the West of England’s energy sector – that the market was entering a new era and was evolving rapidly, with the government trying to balance the need for energy security, with changing usage and affordability considerations.

Maria Connolly said the changing market had encouraged new opportunities to be explored, particularly around energy storage either as a standalone proposition or in conjunction with an existing renewables installation. This in turn had led many businesses themselves to consider how they might benefit from an onsite supply of power from renewable sources.

The new market had also created new opportunities for businesses, said David Pike, and there was a lot of excitement about innovations, such as new uses for high-storage lithium ion batteries. This is creating new revenue streams and the market is working through how these can be valued.

Chris Nishan believed that over and above the corporate social responsibility angle, for many companies, adopting an environmentally friendly business model made good commercial sense – potentially leading to lower waste management and energy costs, as well as new revenue streams.

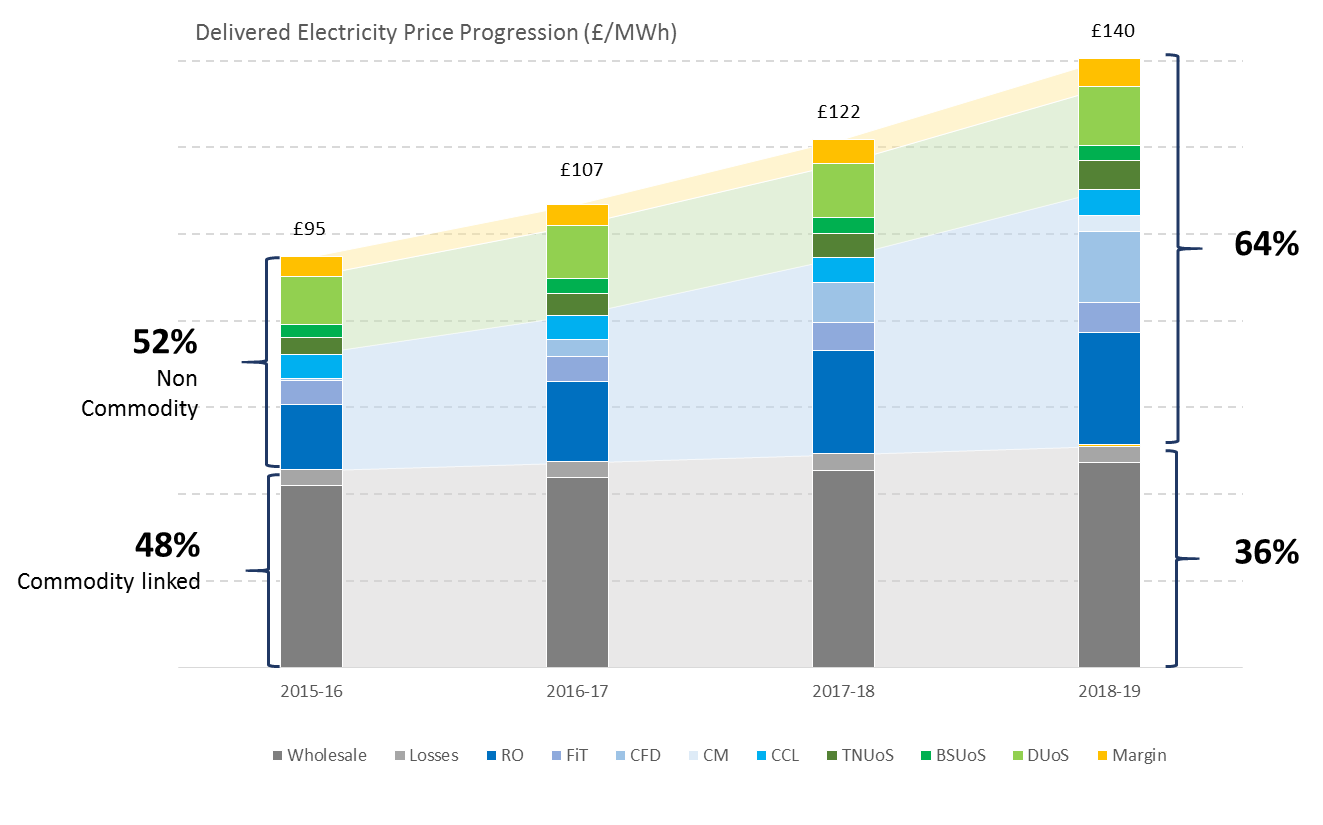

Steve Edwards, from British Solar Renewables, said that according to their projections the cost of power was due to rise by 30%-50% over the next three to five years, so all businesses need to address the cost of their energy consumption. Being able to generate and then store their own power, as well as understanding energy efficiency and the value of avoiding peak periods will become much more important.

The roundtable discussion was chaired by Lee Everson, Barclays head of large corporates, South Wales & South West.